Norwegian investor tax reporting for funds - A significant change as from January 2017

‹ Tilbake til artikler

‹ Tilbake til artikler

The new rules concerning the tax treatment of Norwegian inverstors in investments funds have entered into force in 1. January to:

a) Change the taxation at the hand of the investors in investments fund

b) Require new tax reporting to Norwegian tax authorities as from 2017

c) Chance the taxation for Norwegian tax resident funds

The most important changes

According to the new regulations, the portion of the fund’s equity investments in its portfolio will determine the classification of the unit holder’s type of income and tax treatment. The “equity portion” of the fund must be determined and reported annually.

Norwegian collective investment funds must report information for the investors’ tax assessment directly to the tax authorities. Non-Norwegian funds (offshore funds) don’t have to provide such reporting. However, the Norwegian investors investing in offshore funds will expect these funds to provide relevant tax data to file their tax return.

The taxation of the Norwegian investors

Taxation of Norwegian investors will depend on classification of income from the fund. Investment funds with an equity portion above 80% will be considered “equity income funds”. Meanwhile, investment funds with an equity portion lower than 20% will be considered “interest income funds”. Specific considerations apply for funds having an equity portion between 20% and 80%.

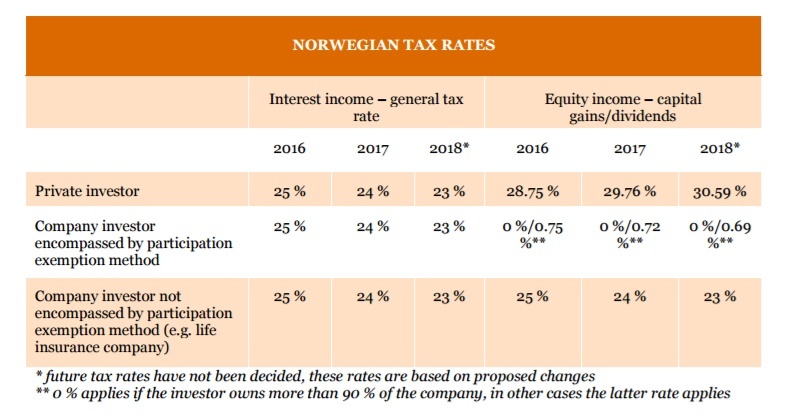

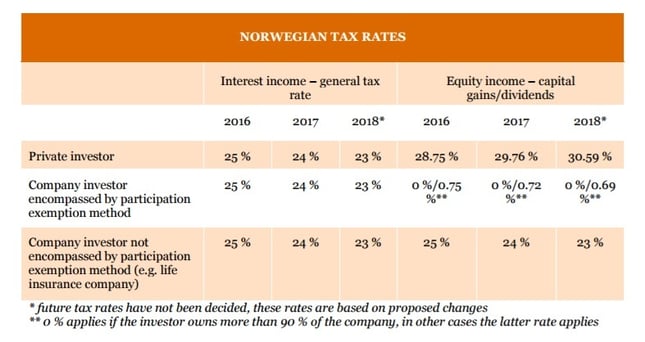

From this classification derive the following taxation rates at the level of Norwegian investors:

Calculation of the equity portion and information to be tracked

The equity portion is calculated by dividing the value of all equity assets by the value of all assets less cash at the beginning of the calendar year. The classification of equity instruments must be done according to Norwegian tax legislation, and can’t be solely based on accounting principles. For example, specific considerations need to be taken into account for investments in target funds or derivative instruments.

Under the Norwegian taxation regime, private investors can enjoy some exemptions on their taxable basis (“tax shield”). For private investors, the tax exemption according to the tax shield regime only applies to the equity portion of the investment. Similarly, for corporate investors encompassed by the participation exemption method, tax exemption only applies to the equity portion of the investment.

When an investment is sold, gains and losses have to be calculated for tax purposes based on a first-infirst-out principle.

Tax reporting for offshore funds

Norwegian investors will seek for investments in offshore funds that offer a reporting, which allows a correct tax treatment. The Norwegian tax reporting is strongly expected to become a market entry hurdle.

The information needed for the tax assessment in Norway is very comprehensive and complex. Data must be collected based on the fund’s investments on 1 January each year, as well as each and every change in the fund’s participation.

The data should contain:

(a) Identification of the investor – whether the investor is private or corporate, and for the latter – whether the participation exemption method applies.

(b) Calculation of the fund’s equity portion as of 1st of January each year. For investments made before 7 October 2015 and invests made between 7 October and 31 December 2015, special regimes apply.

(c) The relevant information on the equity portion whenever the participation in the fund changes and upon any distribution.

In conclusion - how can we help?

We can help fund managers comply with the new Norwegian tax requirements either by reviewing the existing calculation methodology or by providing the required data.

Pre-requisite analysis

We can assist you with an analysis of whether or not the foreign fund is to be classified as a securities fund under the Norwegian Tax Act.

Monitoring model

Technical memo/guideline describing the securities fund regulation and classification of the fund for Norwegian investors.

Review of the equity portion assessment made by the fund manager per 1 January each year for each sub-fund/compartment.

Review the model of calculation developed internally or externally (fund administrator), the list of qualifying assets and answers to ad-hoc questions. We can perform periodical review upon request.

Outsourcing model

We can develop a calculation model based on raw accounting data provided by the fund administrators and prepare required data for you.

Legg igjen en kommentar